Our Financial Education Ideas

Wiki Article

Getting My Financial Education To Work

Table of ContentsThe Greatest Guide To Financial EducationHow Financial Education can Save You Time, Stress, and Money.Financial Education for DummiesThe 15-Second Trick For Financial EducationFinancial Education Things To Know Before You BuyEverything about Financial EducationThe 3-Minute Rule for Financial Education

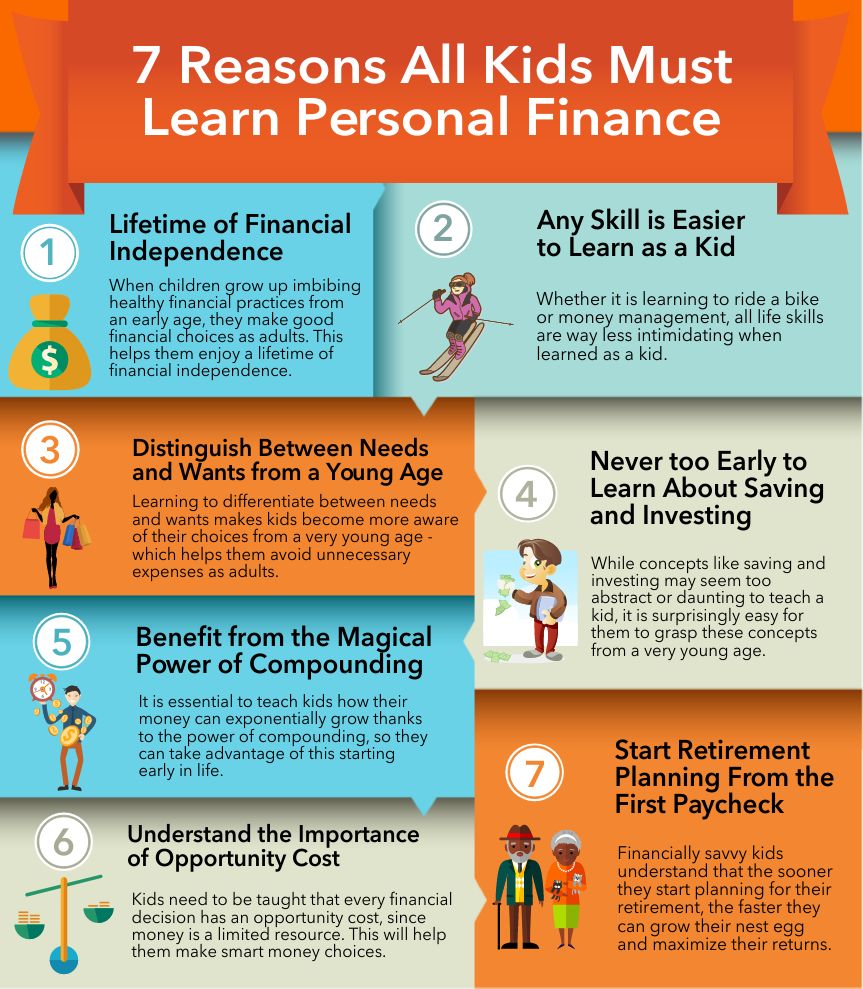

This is their intro to the monetary world. Many believe that a person's economic trip starts when they begin with adulthood, but it begins in childhood years. Kids nowadays have very easy access to almost any kind of resources, whether it is money or some asset that cash can buy. This did not exist in the older generation, where also when resources were readily available, they did not have actually points handed to them.Asking your parents for expensive gifts like an i, Phone, Mac, Book, or Apple Watch, as well as after that tossing tantrums over it demonstrates how you are not prepared for the globe available. Your parents will try to describe this to you, yet youngsters, particularly teenagers, rarely understand this. If not shown the relevance of assuming seriously prior to costs, there will certainly come a time when the next gen will face problems, and also not find out just how to handle financial resources as an adult.

Early learning of concepts like the value of intensifying, the distinction in between wants and needs, delayed satisfaction, opportunity cost and also most importantly obligation will hold the next generation in great stead. Best Nursing Paper Writing Service. Values of possessions and also cash can not be shown overnight, as a result starting young is critical. To put it simply, whether you like it or otherwise, financial monitoring gradually comes to be an indispensable component of life, and also the earlier one begins inculcating the behavior; the earlier they will certainly master it, and also the better prepared they will be.

Rumored Buzz on Financial Education

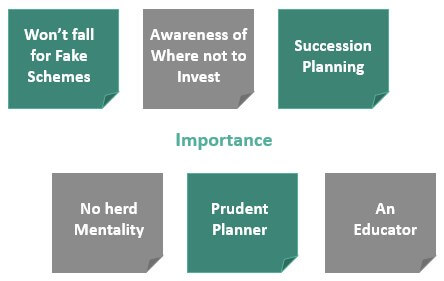

Even if it does exist, it is never ever compulsory. The main reason is the absence of relevance provided to this topic by colleges and also moms and dads alike. If, nevertheless, it is made obligatory in schools or taught by moms and dads at house, the advantages would certainly be profound: 1. Capability to make far better monetary choices 2.

How Financial Education can Save You Time, Stress, and Money.

Parents always consider making certain to keep adequate cash for their youngsters, however, they stop working to comprehend that more action has to be included in their future planning for their children. They must inculcate the fundamentals of financing in young ones before they go out right into the world individually because doing so will certainly make them much more responsible as well as make their life even more hassle-free! Views expressed over are the writer's very own.And you regularly focus on your overall portfolio incomes, savings and financial investments. You additionally recognize what you don't know, and you request aid when you need it. To be monetarily literate methods having the capability to not allow cash or the absence of it hinder of your happiness as you function hard and build an American dream full with a lengthy as well as fulfilling retirement.

Personal money specialists advise putting in the time to find out the basics, from try this web-site just how to manage a monitoring or debit account to how to pay your costs on time and build from there. Handling your cash demands consistent focus to your costs and to your accounts and not living past your monetary ways.

A Biased View of Financial Education

You will certainly miss out on out on rate of interest created by a savings account. With cash in an account, you can start investing.You require to see specifically just how you're spending your cash as well as identify where your economic holes are. 1. Beginning tracking your regular monthly expenses In a notebook or a mobile app, compose in each time you spend cash. Be attentive concerning this, since it's easy to neglect. This is the structure for your budget.

As well as which ones can you really do without? Be truthful, and start cutting. This is the start of the difficult choices.

See This Report on Financial Education

Aspect in savings An essential component of budgeting is that you need to constantly pay on your own. That is, you should take a portion of every income and placed it right into savings. This method, if you can make it a behavior, will pay rewards (actually in most cases) throughout your life.Currently establish your spending plan Beginning making the needed cuts in your dealt with and variable expenditures. Determine what you wish to conserve every week or every two weeks. The remaining money is just how much you need to live on. Efficient budgeting needs that you are honest with yourself as well as created a strategy that you can in fact adhere to.

Debit cards have advantages like no restriction on the quantity of purchases and rewards based upon constant use. You have the capacity to invest without carrying cash as well as the cash is promptly withdrawn from your account. Since making use of the card is so simple, it is vital that you don't overspend and lose track of just how usually you're spending with this account.

The Main Principles Of Financial Education

Some resorts, vehicle rental firms and also other businesses require that you make use of a credit rating card. You can establish your debt background and also take benefit of the time buffer in between making an acquisition and paying your expense.Relying upon a credit report card can cause taking on major financial debt. Should you select to possess a charge card, the most effective method of action is paying completely every month. It is likely you will currently be paying interest on your acquisitions as well as the more time you rollover a balance from month to month, the even more interest you will certainly pay.

The record click here for more info likewise claimed the this content average consumer has a bank card equilibrium of $5,897. Complete Debt for American Consumers = $11. 74 trillion Economist Chip Stapleton uses a wise strategy to get and avoid of financial debt that any person can practice. A credit report score can be a solid indicator of your financial wellness.

The Best Strategy To Use For Financial Education

You can get a duplicate of your debt report for complimentary once each year from each of the credit score bureaus. Developing a high credit history can assist you obtain approval for low-interest lendings, credit report cards, mortgages, as well as car payments. When you are looking to move into an apartment or condo or get a brand-new work, your credit rating might be a deciding element.Report this wiki page